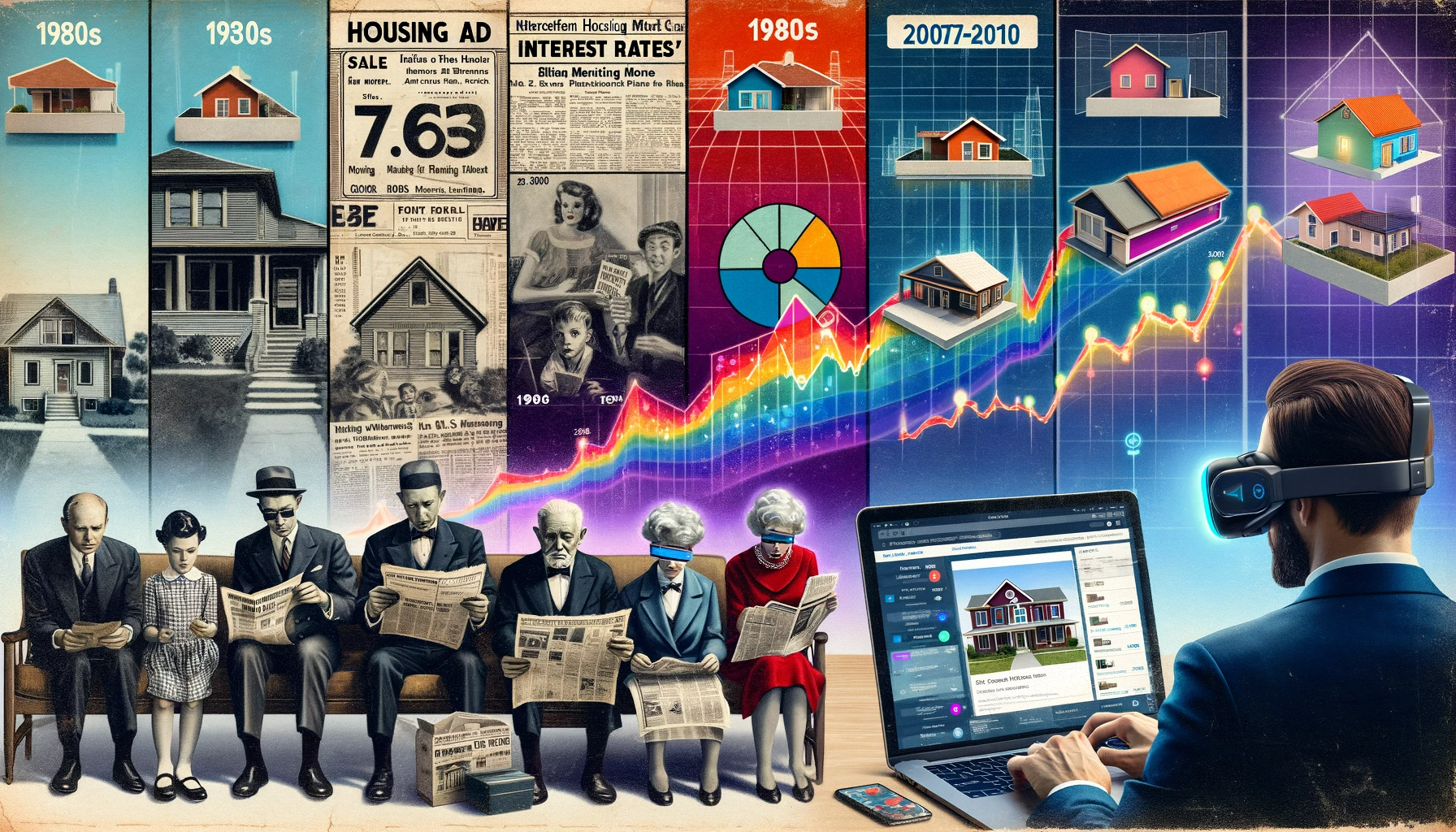

The U.S. housing market has experienced several significant downturns throughout history, each presenting unique challenges and opportunities for marketers. Here’s a historical overview of these crashes and the adaptive marketing strategies employed during these times.

The Great Depression (1929-1939)

The Crash: The collapse of the stock market in 1929, combined with bank failures, led to a severe contraction in consumer wealth and spending power, contributing to a precipitous decline in housing demand and prices.

Marketing Adaptation: Marketers of the era relied on print media, but the approach was more nuanced than mere emotional appeals. They used economic data and trends to inform the public about the long-term value of real estate, often employing persuasive copywriting that highlighted the tangibility and inherent value of property compared to volatile stocks.

The Savings and Loan Crisis (1980s)

The Crash: This was a failure of banking institutions that had engaged in risky lending practices. As interest rates rose to counteract inflation, many loans defaulted, leading to a surplus of properties on the market and plummeting prices.

Marketing Adaptation: Marketers began using targeted demographic data to personalize direct mail campaigns, understanding that different age groups and socio-economic segments had distinct concerns and motivations. The burgeoning field of database marketing allowed for segmentation and more sophisticated modeling of consumer behavior.

The Dot-com Bubble Burst (2000)

The Crash: The collapse of tech stock valuations had a cascading effect on consumer spending and investment, impacting the broader economy and causing a slowdown in the housing market.

Marketing Adaptation: This period saw the rise of digital marketing. Marketers used early analytics to track the performance of online listings and email campaigns, adjusting tactics in real-time based on consumer engagement metrics. This period also saw the advent of Customer Relationship Management (CRM) systems, which helped in maintaining communication with potential buyers despite economic uncertainty.

The Subprime Mortgage Crisis (2007-2010)

The Crash: The housing bubble, driven by low interest rates and high-risk lending, burst when adjustable-rate mortgages reset at higher interest rates, causing a wave of defaults and foreclosures.

Marketing Adaptation: Marketers focused on digital channels, with a strong emphasis on SEO to capture the attention of potential homebuyers searching for affordable housing options. They utilized data-driven strategies to identify and target regions less affected by the crisis, and content marketing to educate consumers on navigating the complex landscape of home buying and financing during a recession.

COVID-19 Pandemic (2020-Present)

The Crash: The pandemic-induced economic shock caused a short-term disruption in the housing market, with a significant impact on consumer mobility and the perception of home as a safe haven.

Marketing Adaptation: Marketers quickly pivoted to virtual platforms, employing sophisticated online viewing technologies and 3D modeling to offer immersive property experiences. They leveraged social media platforms’ algorithmic targeting to reach potential buyers with personalized ads and utilized chatbots and AI-driven customer service tools to engage with clients in real-time, addressing concerns about safety and investment security.

Conclusion

Throughout each crisis, marketers have had to rapidly adapt to changing economic landscapes and consumer sentiments. They’ve leveraged technological advancements, from print to digital analytics, to develop targeted, data-informed strategies. By understanding the shifts in consumer priorities and the evolving digital ecosystem, marketers have been able to navigate the challenges presented by each housing market downturn, often emerging with new techniques that set the stage for future innovations in the field.